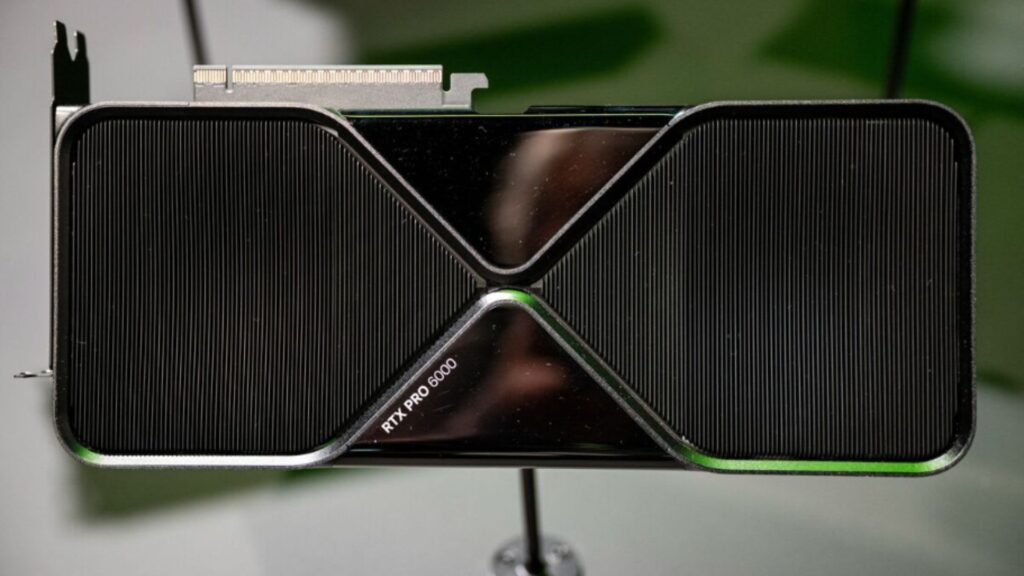

China’s Cyberspace Administration has ordered the country’s largest technology companies to cease purchasing Nvidia artificial intelligence chips and cancel existing orders, marking Beijing’s most aggressive move yet to reduce dependence on U.S. semiconductor technology. The directive specifically targets Nvidia’s RTX Pro 6000D, a chip designed exclusively for the Chinese market to comply with U.S. export restrictions (Financial Times via Telegraph India).

Major Tech Firms Forced to Cancel Orders

The Cyberspace Administration of China (CAC) directed major technology firms including ByteDance and Alibaba this week to terminate testing programs and cancel orders for Nvidia’s China-specific processors. Several companies had planned to order tens of thousands of RTX Pro 6000D units and had begun evaluation with Nvidia’s server suppliers before receiving the halt order (Bloomberg).

The directive represents a more stringent approach than previous regulatory guidance, which had focused primarily on Nvidia’s H20 chip. The RTX Pro 6000D was among the last Nvidia products the company could sell in China in significant volumes following U.S. export controls implemented in 2022.

Escalating Trade War Tensions

The ban follows China’s accusation that Nvidia violated the country’s anti-monopoly laws in its 2020 acquisition of Mellanox Technologies, announced just days prior (CNN). The timing coincides with ongoing trade discussions between U.S. and Chinese officials in Madrid, where negotiators are attempting to broker broader economic agreements amid deteriorating technology relations.

China’s State Administration for Market Regulation launched a formal investigation into the Mellanox deal, which had previously received approval from global regulators including the European Union. The probe centers on allegations that the acquisition gave Nvidia unfair advantages in high-performance networking technology critical for AI data centers.

Domestic Chip Industry Benefits

Beijing’s directive reflects growing confidence in domestic semiconductor capabilities. Chinese regulators have summoned local chipmakers including Huawei and Cambricon Technologies, along with tech giants Alibaba and Baidu, to report how their products compare against Nvidia’s China-specific offerings.

Cambricon Technologies has emerged as the primary beneficiary of this policy shift, reporting record earnings with a 1.03 billion yuan profit ($144 million) in the first half of 2025, compared to a 533 million yuan loss in the same period last year. The company’s revenue surged approximately 44-fold to 2.9 billion yuan as Chinese firms increasingly adopt domestic alternatives to U.S. processors.

Industry sources indicate that Chinese chipmakers are positioning to triple the country’s total AI processor output next year, supported by government subsidies and preferential procurement policies favoring domestic suppliers.

Market Impact and Strategic Implications

Nvidia shares fell 1 percent in premarket trading following news of the directive. The Chinese market represented 13 percent of Nvidia’s total sales in 2024, making Beijing’s restrictions a material concern for the semiconductor giant’s growth trajectory.

However, market reception of the RTX Pro 6000D had already been lukewarm among major Chinese technology firms. Some companies opted against placing orders due to perceived overpricing relative to performance capabilities. Initial testing revealed the chip’s performance fell short compared to alternatives available through gray market channels, including older-generation Nvidia processors imported before export controls took effect.

The directive marks the latest escalation in the intensifying technology competition between the United States and China, as both nations seek to maintain advantages in artificial intelligence development while reducing dependence on foreign suppliers. Beijing’s move signals a strategic pivot toward technological self-reliance, even at the cost of potentially slower AI development in the near term.

Industry analysts expect further restrictions on U.S. technology imports as China prioritizes building domestic capabilities across the entire semiconductor supply chain, from design and manufacturing to advanced packaging and testing capabilities.