The quantum computing sector has entered a new phase of rapid growth, with companies raising over $1.5 billion in funding within a single week—a record concentration of investment that underscores institutional confidence in moving quantum technologies from experimental research toward commercial viability. Finland’s IQM Quantum Computers led the surge with a $320 million Series B round, the largest quantum funding outside the United States, while Quantinuum secured $600 million at a $10 billion valuation and QuEra Computing expanded its Series B to $230 million with backing from Nvidia’s venture arm.

This investment wave reflects a broader industry shift toward developing fault-tolerant, large-scale quantum systems and integrating them with classical computing infrastructure. PsiQuantum also raised $1 billion in Series E financing at a $7 billion valuation, highlighting diverse technology approaches—from superconducting qubits to photonic chips—and reinforcing the view that quantum computing is approaching a commercial inflection point.

Major Funding Rounds Spotlight Industry Growth

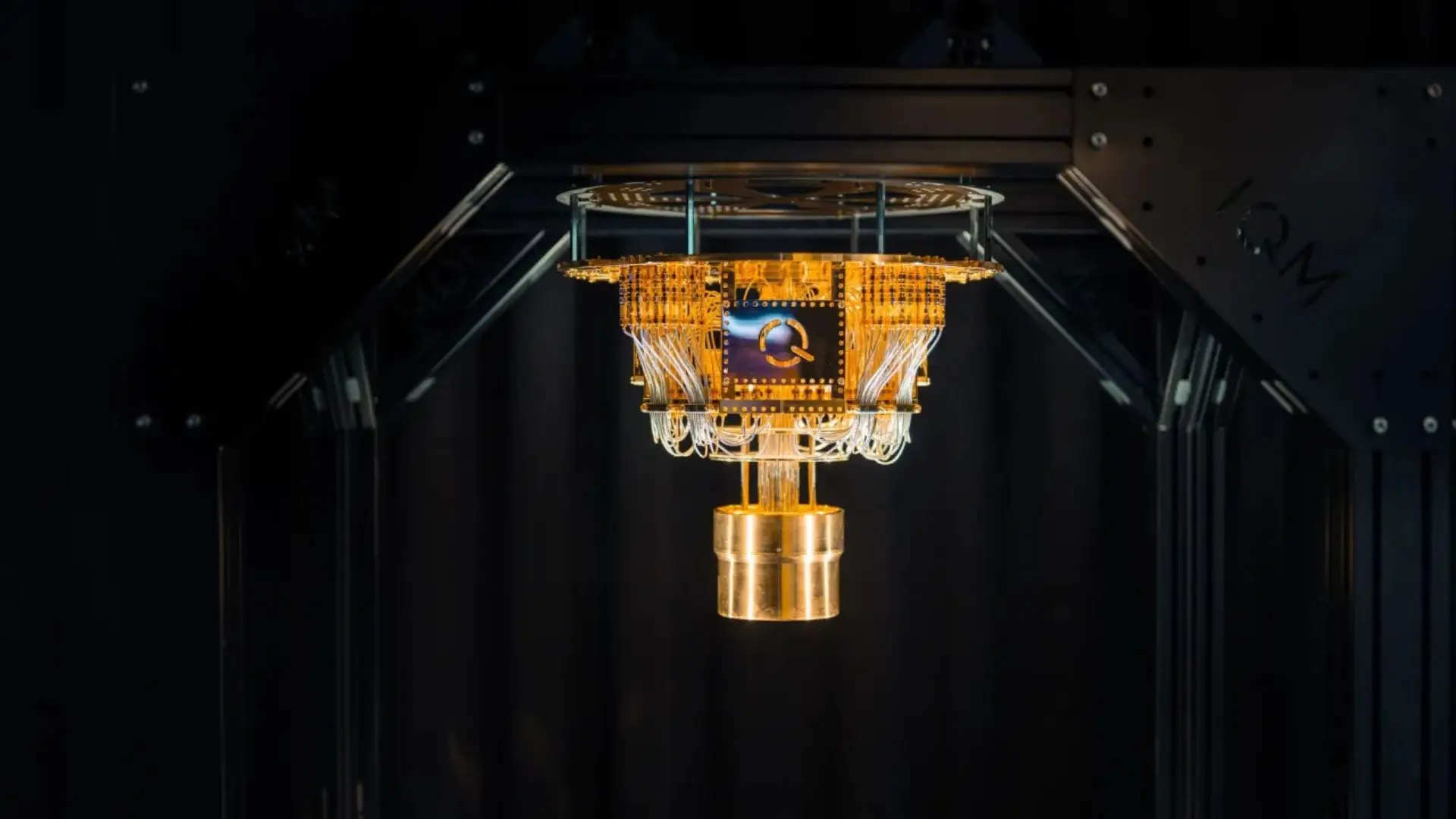

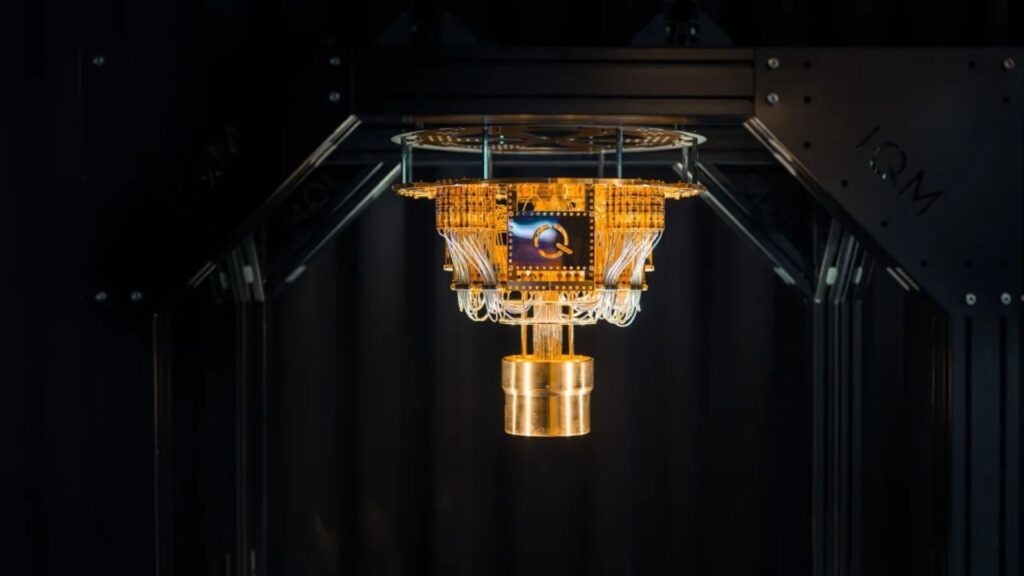

IQM Quantum Computers’ $320 million Series B infusion brings its total capital raised to $600 million and aims to accelerate its roadmap from thousands to millions of qubits with advanced error correction capabilities. The round, led by Ten Eleven Ventures alongside U.S. and European investors, positions IQM to expand its commercial presence beyond its Nordic stronghold.

Quantinuum, majority-owned by Honeywell, announced a $600 million funding at a $10 billion pre-money valuation. The round included participation from JPMorgan Chase, reflecting financial institutions’ growing interest in deploying quantum algorithms for risk analysis and portfolio optimization. Quantinuum’s technology combines trapped-ion qubits with proprietary control systems designed for scalability and industrial applications.

QuEra Computing expanded its Series B to $230 million, with Nvidia’s NVentures leading the round. QuEra’s neutral-atom qubit architecture has been integrated into Japan’s ABCI-Q supercomputer alongside over 2,000 Nvidia H100 GPUs, demonstrating early hybrid quantum-classical performance gains in optimization and simulation tasks.

Hybrid Quantum-Classical Partnerships Fuel Innovation

Nvidia’s venture arm, NVentures, has emerged as a key backer in the quantum space, participating in at least three major rounds within a single week. This strategic shift reflects Nvidia CEO Jensen Huang’s view that quantum computing is at an “inflection point” and that hybrid systems will unlock near-term practical applications.

QuEra’s partnership with Nvidia exemplifies this trend: its Gemini-class quantum computer installed alongside traditional GPUs enables researchers to offload subroutines to quantum processors while leveraging vast classical compute resources. Such integrations aim to tackle complex problems in materials science, logistics, and machine learning by combining qubit parallelism with GPU acceleration.

JPMorgan Chase’s involvement in Quantinuum’s financing underscores enterprise confidence in quantum computing’s promise for high-value use cases like derivative pricing, fraud detection, and secure communications. Financial institutions are exploring quantum algorithms that could one day outperform classical methods in speed and accuracy.

Commercialization Timelines and Market Projections

With over $1.5 billion in new funding, quantum companies are increasingly targeting commercialization milestones. IQM plans to advance error-corrected qubit architectures and deploy pilot systems with industry partners by 2026, while PsiQuantum’s photonic approach targets the world’s first million-qubit, fault-tolerant quantum computer, with facilities slated for Brisbane and Chicago.

Industry analysts suggest the quantum computing market could reach $97 billion by 2035, driven by sectors such as pharmaceuticals, finance, and defense. The funding surge—up 128% year-over-year in Q1 2025—signals a transition from research grants to deployment capital, as investors bet on near-term revenue streams from quantum-enabled services and hardware sales.