Elon Musk announced on September 1, 2025, that roughly 80% of Tesla’s future value will derive from its Optimus humanoid robot rather than electric vehicles, signaling a major strategic pivot as the company faces its lowest U.S. market share in nearly eight years.

Declining Automotive Performance Drives Strategic Pivot

Tesla’s U.S. EV market share dropped from over 80% at its peak to 38% in August 2025—the first sub-40% reading since October 2017—according to Cox Automotive. Despite a 24% surge in overall U.S. EV sales from June to July, Tesla grew just 3.1% in August versus the market’s 14% expansion. Globally, European sales fell 40% and Chinese deliveries declined 6% in 2025. Analysts attribute this slump to a lack of new vehicle models since the Cybertruck’s 2023 launch, describing Tesla’s automotive lineup as stagnant (Electrek).

Wall Street Embraces AI Vision Despite Talent Exodus

Wall Street has rewarded Tesla’s robotics focus. On September 19, Baird upgraded the stock to “Outperform,” raising its price target to $548 from $320, citing Tesla as “the leader in physical AI” and forecasting potential share prices of $3,000 by 2035 if robotics milestones are met (Business Insider). Goldman Sachs lifted its target to $395 from $300 while maintaining a neutral rating, noting upside if humanoid robotics and autonomy capture significant market share. However, Tesla faces internal challenges: Ashish Kumar, AI team lead for Optimus, departed on September 19 to join Meta, citing non-financial reasons despite “significantly larger” financial upside at Tesla.

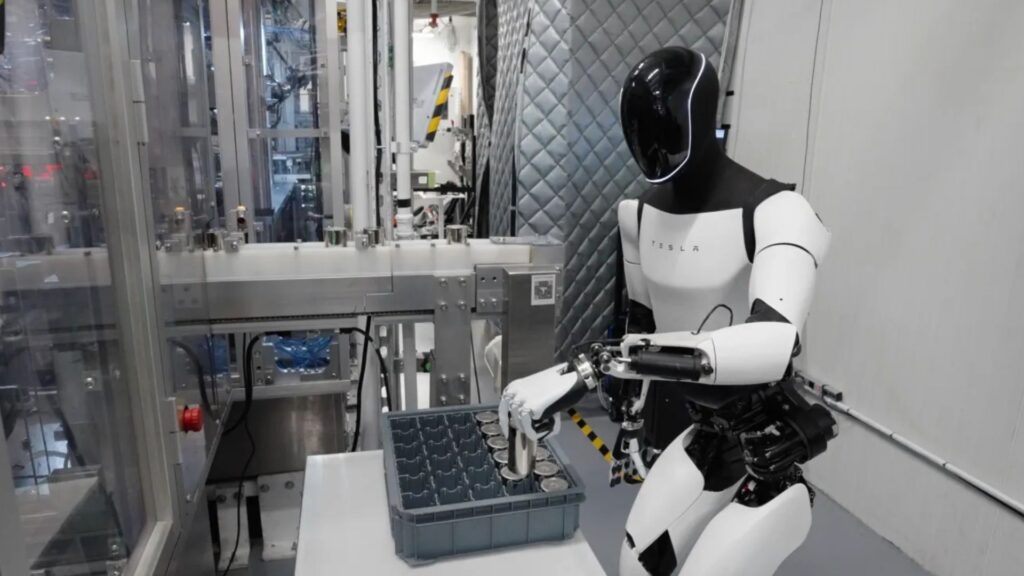

Ambitious Robotics Timeline Faces Reality Test

Tesla aims to deploy thousands of Optimus units in its factories by end-2025 and scale to one million robots annually by 2030, with projected prices between $20,000 and $30,000. Musk envisions Optimus driving Tesla toward a $25 trillion market capitalization and unlocking a $10 trillion robotics opportunity. “Master Plan Part 4” places humanoid robotics at the core of “sustainable abundance.” Yet analysts caution that Tesla must execute against fierce competition from established players like Boston Dynamics and well-funded startups such as Figure AI, backed by Microsoft, Nvidia, and OpenAI (CoinCentral).

Thanks for sharing. I read many of your blog posts, cool, your blog is very good. https://accounts.binance.info/es-MX/register?ref=GJY4VW8W