Nvidia announced on Thursday that it will invest $5 billion to acquire a 4% stake in Intel, driving Intel’s shares up over 30% in premarket trading. Under the agreement, Nvidia will purchase Intel common stock at $23.28 per share—below Intel’s Wednesday closing price of $24.90—making Nvidia one of Intel’s largest shareholders once the deal closes, pending regulatory approval (Reuters).

Strategic Collaboration on AI and PC Chips

The investment cements a partnership in which Intel and Nvidia will co-develop “multiple generations” of custom processors for both data centers and personal computers. Intel will design bespoke x86 data-center CPUs tailored for Nvidia’s AI infrastructure platforms, while also engineering x86 system-on-chips that incorporate Nvidia RTX GPU chiplets for the PC market.

Central to the collaboration is Nvidia’s NVLink high-speed interconnect, enabling cohesive communication between Intel CPUs and Nvidia GPUs. This tight integration aims to optimize performance in AI workloads, where accelerators and general-purpose processors must coordinate to process massive datasets efficiently.

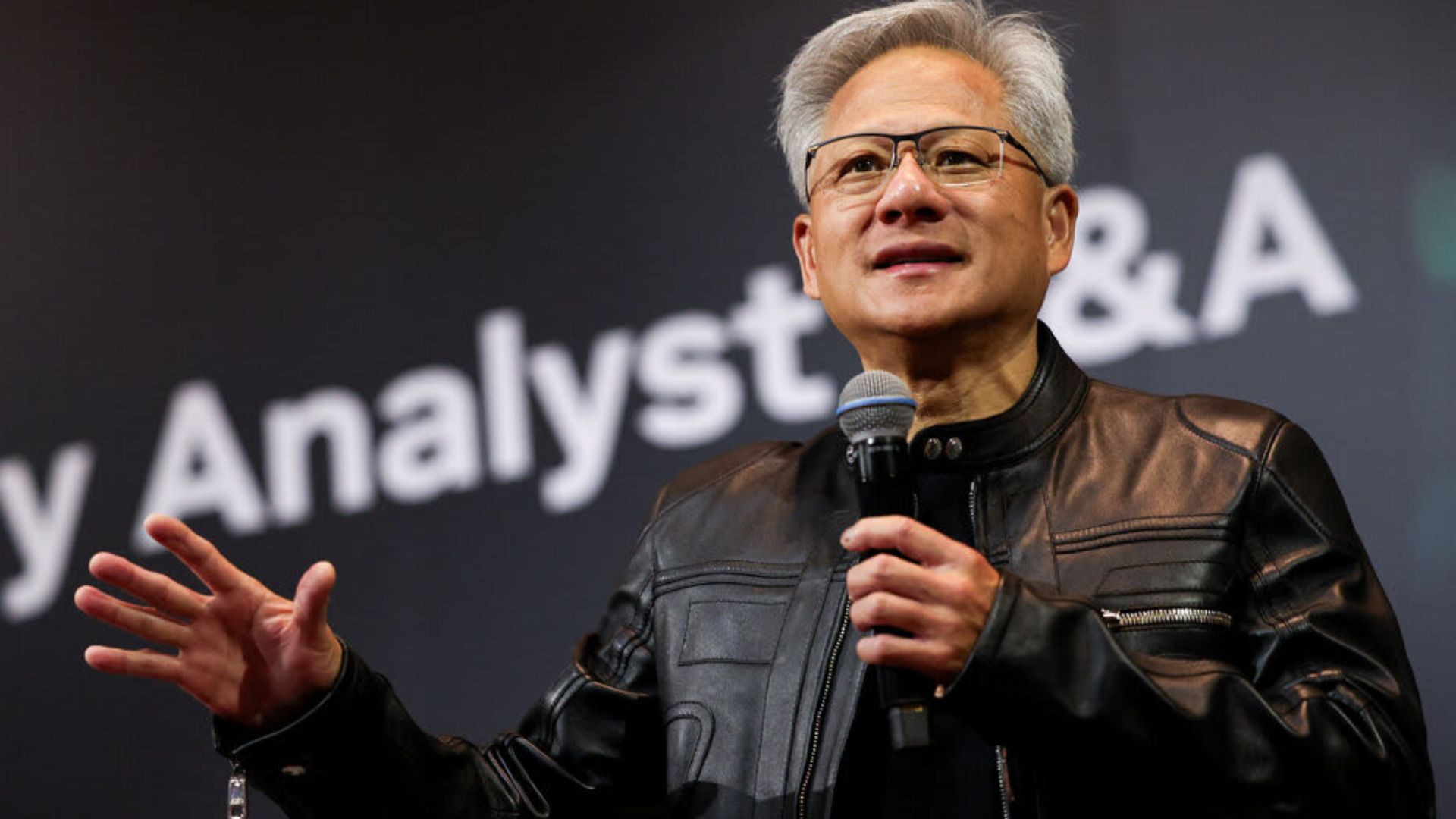

“This historic collaboration tightly couples Nvidia’s AI and accelerated-computing stack with Intel’s CPUs and the vast x86 ecosystem—a fusion of two world-class platforms,” said Jensen Huang, Nvidia’s founder and CEO. “Together, we will expand our ecosystems and lay the foundation for the next era of computing.”

Lifeline for Intel’s Turnaround

The deal provides a significant boost to Intel, which has faced challenges adapting to the shift from PC dominance to mobile and AI-driven markets. Just last month, the U.S. government took a 10% equity stake in Intel under an $8.9 billion federal funding package aimed at strengthening domestic chip manufacturing.

Intel’s CEO Si-Sun “Lip-Bu” Tan, appointed in March, has emphasized operational efficiency and capacity investment aligned with demand. “We appreciate the confidence Jensen and the Nvidia team have placed in us with their investment,” Tan said, noting that the partnership validates Intel’s strategic refocus on data-center and high-performance computing.

Competitive Implications for the Chip Industry

The collaboration poses new competitive dynamics for Taiwan Semiconductor Manufacturing Company (TSMC)—which currently manufactures Nvidia’s flagship GPUs—and AMD, Intel’s rival in data-center processors. Following the announcement, AMD’s stock fell nearly 4%, while TSMC’s U.S.-listed shares dropped 2%.

Analysts note that the deal notably excludes Intel’s foundry division from producing Nvidia chips, a point of contention given Intel’s broader ambitions to challenge TSMC’s foundry leadership. Both companies confirmed that their existing product roadmaps remain unchanged, but provided no timeline for the release of jointly developed solutions.

Market Reaction and Outlook

The market greeted the news with enthusiasm for Intel’s near-term valuation boost and for the promise of synergistic product innovation. Intel’s share rally reflects investor optimism that the company can leverage Nvidia’s AI expertise while stabilizing its core CPU business. For Nvidia, the deal secures closer alignment with the x86 ecosystem and diversified revenue through equity appreciation in Intel.

As the transaction proceeds through regulatory review, stakeholders will watch for details on joint product roadmaps and how the partnership influences the competitive landscape among semiconductor foundries and AI-acceleration platforms.