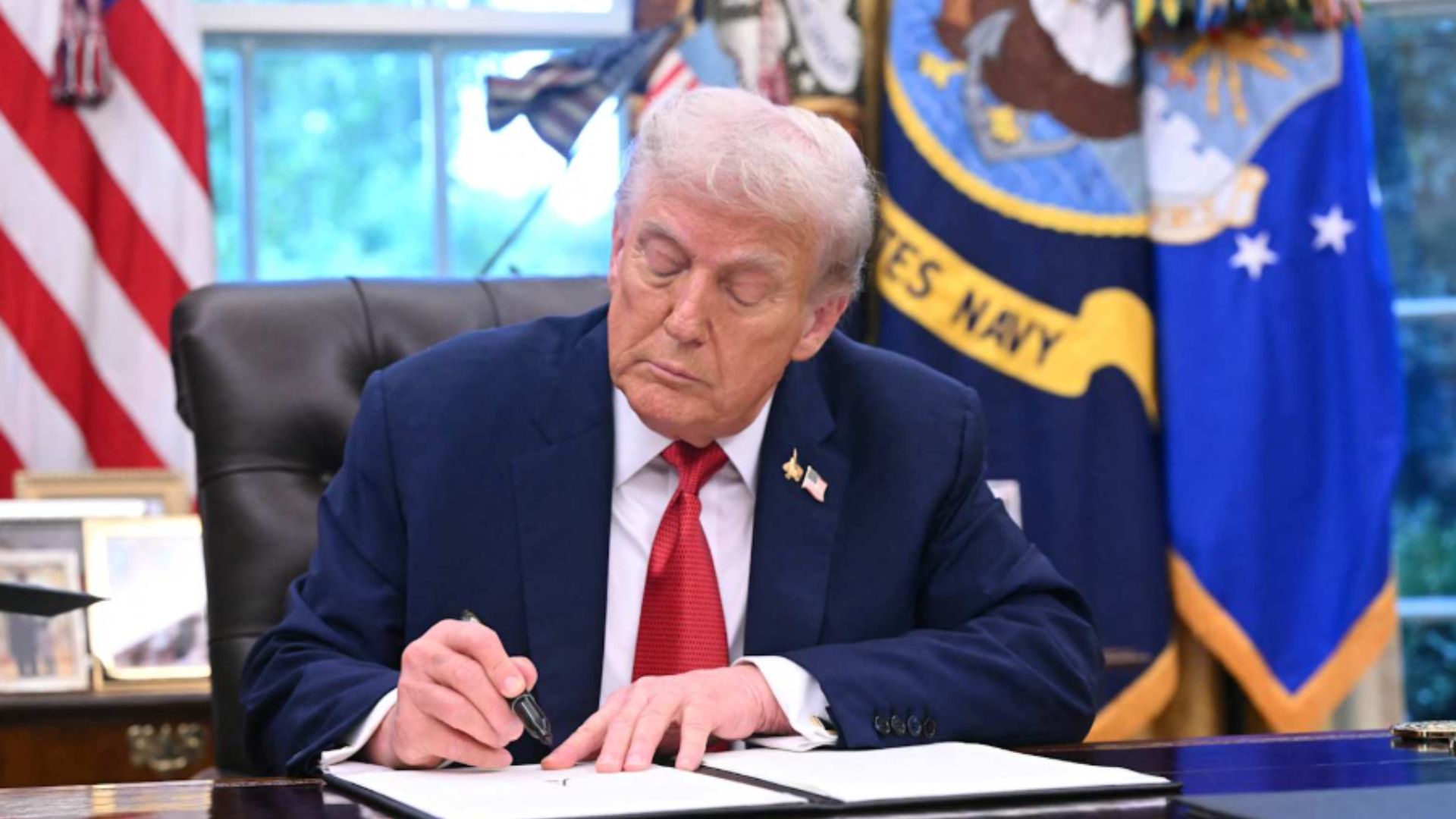

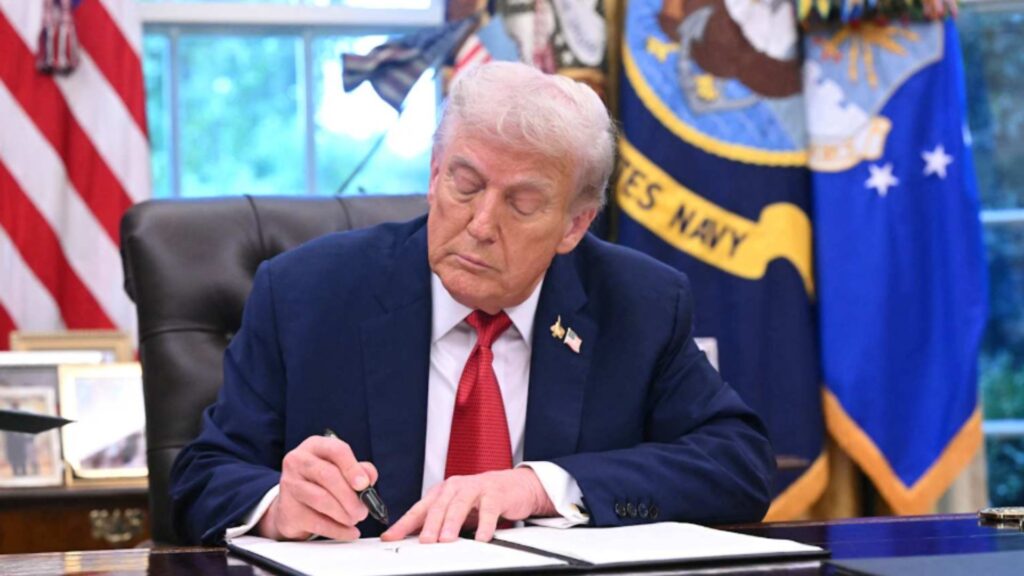

President Donald Trump delivered a dual economic and technological policy announcement Thursday, unveiling comprehensive import tariffs scheduled for October 1 while simultaneously signing an executive order approving a $14 billion deal to transfer TikTok’s U.S. operations to American investors. The coordinated announcements underscore Trump’s strategy of using economic leverage and national security justifications to reshape both trade relationships and technological sovereignty.

Market Reaction and Industry Concerns

Asian pharmaceutical markets opened sharply lower Friday following Trump’s tariff announcement. India’s Nifty Pharma index plummeted 2.3% at the opening bell, with individual companies experiencing severe declines—Natco Pharma, Gland Pharma, and Sun Pharma falling up to 4% in early trading. Japan’s Topix Pharma Index also declined 1.39% as investors assessed the potential impact on global pharmaceutical supply chains.

The pharmaceutical sector faces the steepest penalties under Trump’s new tariff regime, with a punishing 100% duty on branded and patented drug imports unless companies are actively constructing manufacturing facilities in the United States. The policy exempts generic drug formulations, potentially benefiting domestic pharmaceutical players who export lower-cost generics to the U.S. market. Companies like Dr. Reddy’s, Sun Pharma, Lupin, and Aurobindo have historically derived substantial revenue from American demand for affordable generic medications.

The Pharmaceutical Research and Manufacturers of America warned that tariffs could “jeopardize plans because every dollar spent on tariffs is a dollar that cannot be invested in American manufacturing or in the development of future treatments and cures”. Industry data reveals that 53% of the $85.6 billion worth of ingredients used in U.S. medicines are already produced domestically, with the remainder sourced from European allies and other partners.

Trump also announced a 25% tariff on heavy trucks manufactured outside the United States, targeting imports that have tripled since 2019, primarily from Mexico. Additional duties include 50% tariffs on kitchen cabinets and bathroom vanities, and 30% on upholstered furniture, justified as necessary to combat “large scale ‘FLOODING’ of these products into the United States by other outside Countries” for national security reasons.

TikTok’s American Future Secured

Simultaneously, Trump signed an executive order facilitating TikTok’s continued operation under majority American ownership, resolving months of uncertainty for the platform’s 170 million American users. The deal, valued at approximately $14 billion, establishes a new joint venture where Oracle, Silver Lake, and Abu Dhabi’s MGX will collectively control around 45% of TikTok USA. ByteDance will retain less than 20% ownership, meeting the requirements of a 2024 law demanding divestiture or facing a U.S. ban.

“This will be operated by Americans entirely,” Trump declared during the signing ceremony, emphasizing that Chinese President Xi Jinping had approved the arrangement. Oracle will oversee the app’s security operations and algorithm management for American users, while the new entity will feature a board with six American members and one ByteDance appointee.

The $14 billion valuation has surprised many industry observers, falling well below previous estimates that approached $40 billion. Ashwin Binwani, founder of Alpha Binwani Capital, characterized the proposal as potentially “the most undervalued tech acquisition of the decade,” suggesting the amount represents only a third of TikTok’s actual worth. However, the lower valuation may facilitate deal completion while addressing national security concerns about Chinese data access.

Notable investors include Oracle co-founder Larry Ellison, media mogul Rupert Murdoch and his son Lachlan, and Dell Technologies CEO Michael Dell. Existing ByteDance investors such as General Atlantic, Susquehanna, and Sequoia are expected to invest equity in the new TikTok USA entity.

The agreement grants negotiators until mid-January to finalize technical details, with Oracle expected to manage data security and content moderation systems. The deal does not involve federal government equity participation or a “golden share” arrangement, instead relying on private American ownership to address security concerns.

Both announcements reflect Trump’s broader strategy of using economic tools to advance national security objectives while reshaping America’s technological and trade relationships with China and other nations.